Advertisement|Remove ads.

Enviro Infra Surges On Deal Wins: SEBI RA Sameer Pande Sees 20% Upside Potential Ahead

Enviro Infra Engineers ended over 10% higher on Tuesday after the company bagged domestic orders worth ₹306.3 crore for sewage treatment projects in Chhattisgarh. Additionally, it marked its entry into the renewable energy space with two solar power projects totaling 69 MW.

According to SEBI-registered analyst Sameer Pande, the stock could be hitting record highs soon after showing breakout signs on a popular technical indicator.

Enviro Infra Engineers stock is still nearly 40% below its record high of ₹325.4.

The stock experienced a surge in volumes, while the relative strength index (RSI) spiked sharply from 42 to 71 in just one session, indicating a strong upward momentum, Pande said.

The stock is likely to face resistance at around the ₹260-270 levels, while support can be seen at around ₹220-210, he added.

While placing a stop loss at ₹180, Pande said that every dip toward the support zone is seen as a buying opportunity. He set a target of ₹285 to be achieved by August end.

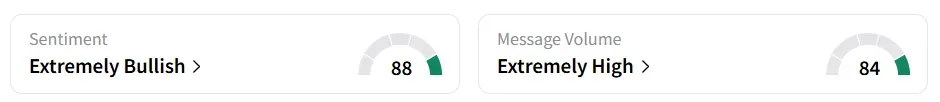

Retail sentiment on Stocktwits turned ‘extremely bullish’ from ‘neutral’ a day earlier, amid ‘extremely high’ message volumes.

Year-to-date, the stock has lost over 25%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Vanda_jpg_943c16fa4f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_brian_armstrong_OG_jpg_3ac8291bf2.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_donald_trump_jpg_39d73f48c3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2212776621_jpg_54c763cf43.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2226079120_jpg_10ed2924af.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_OG_oct23_jpg_588046d0a9.webp)